Do you want to find 'income tax essay'? Here you can find questions and answers about the issue.

Table of contents

- Income tax essay in 2021

- What is income tax used for

- Advantages of income tax

- Essay on the wealth tax

- Types of income tax

- Disadvantages of income tax in points

- Income taxation pdf

- Argumentative essay on taxes

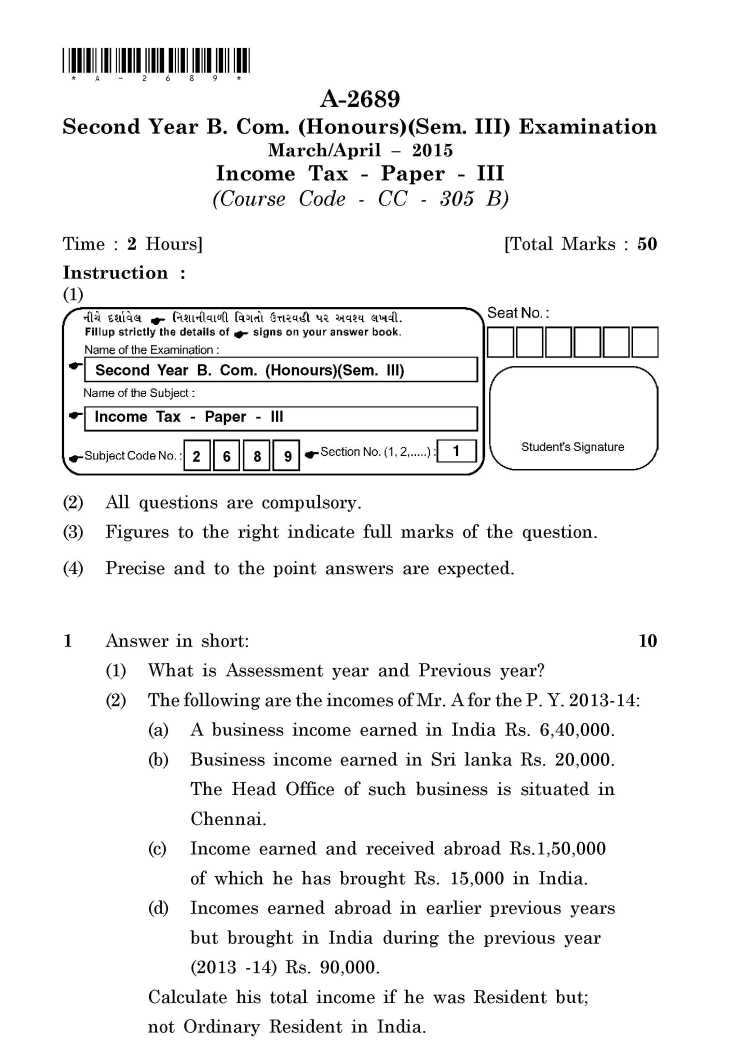

Income tax essay in 2021

This picture shows income tax essay.

This picture shows income tax essay.

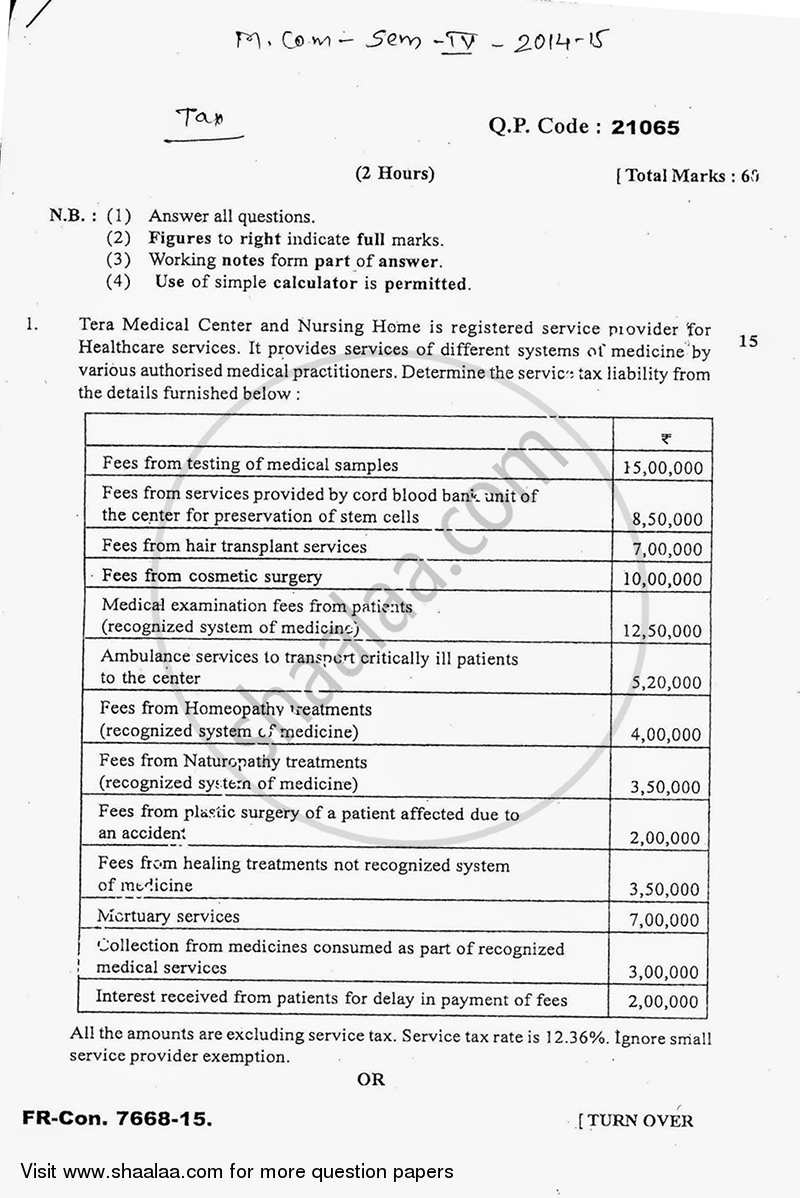

What is income tax used for

This image shows What is income tax used for.

This image shows What is income tax used for.

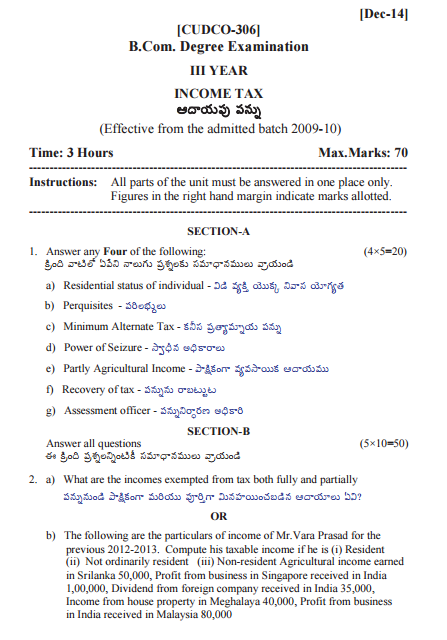

Advantages of income tax

This image representes Advantages of income tax.

This image representes Advantages of income tax.

Essay on the wealth tax

This picture representes Essay on the wealth tax.

This picture representes Essay on the wealth tax.

Types of income tax

This picture representes Types of income tax.

This picture representes Types of income tax.

Disadvantages of income tax in points

This picture demonstrates Disadvantages of income tax in points.

This picture demonstrates Disadvantages of income tax in points.

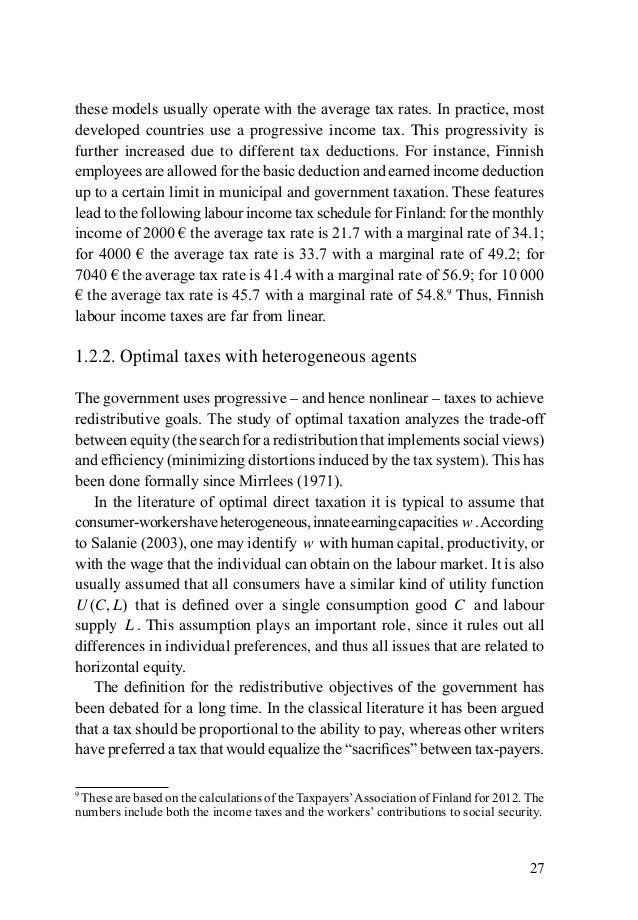

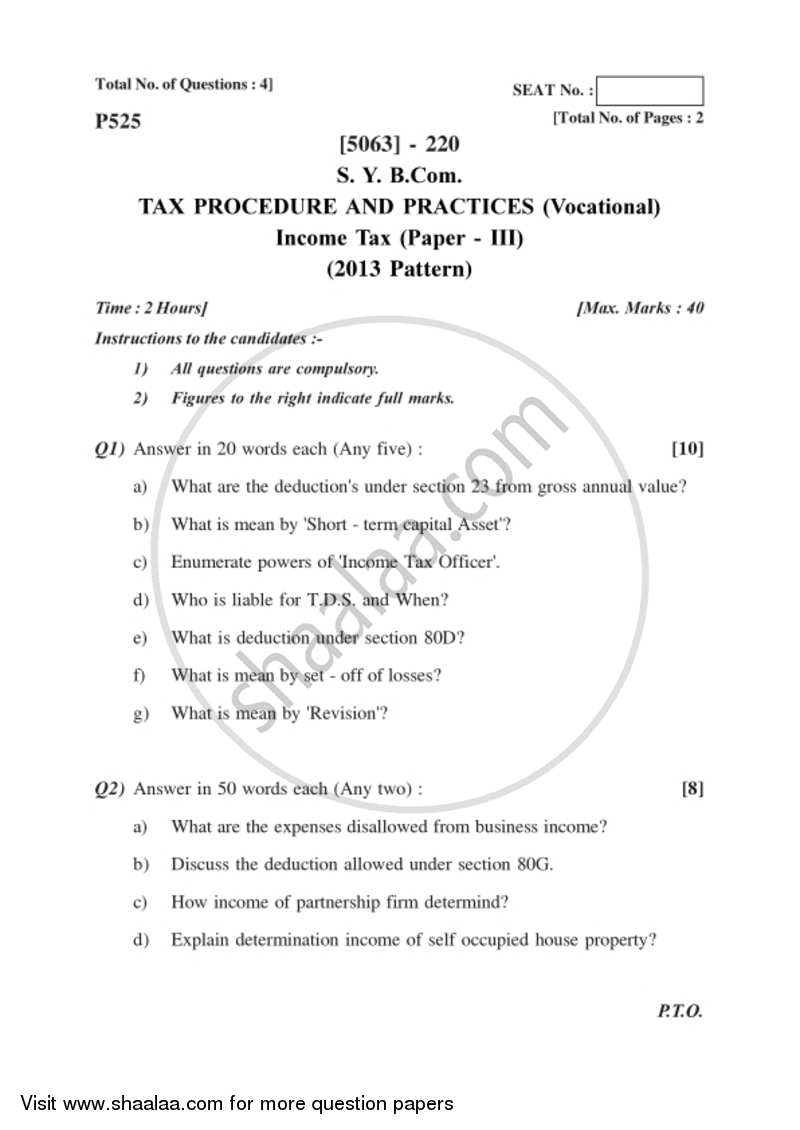

Income taxation pdf

This image representes Income taxation pdf.

This image representes Income taxation pdf.

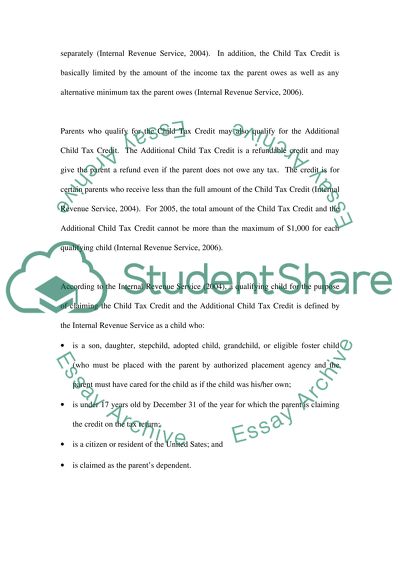

Argumentative essay on taxes

This picture shows Argumentative essay on taxes.

This picture shows Argumentative essay on taxes.

How to write an essay about paying taxes?

Give reasons for your answer and include any relevant examples from your own experience or knowledge. Write at least 250 words. People work hard and earn money which ideally they would like to retain for themselves. However, a significant portion of this usually has to be given to the state.

How many words are in an essay on government taxation?

Every statute which takes away or impairs rights acquired under existing laws, or creates a new obligation or imposes a new duty, or attaches a new disability in respect of transactions already passed , must be presumed to be intended not Should The Uk Government Restore The 50 % Additional Rate Of Income Tax? Essay

What is the impact of taxes on the economy?

Income tax has always been making a significant impact on any country’s economy. Very high or low income tax does not necessarily mean to aid economy of any country. An optimum income tax rate depending upon country’s economical, social goals is necessary in order to realize the real benefits of income tax.

How are individual and corporate income taxes different?

Individual income taxes often tax the total earning of the individual, while corporate tax often taxes net profit of the company. Different tax systems exist, with varying degrees of tax incidence. Income taxation can be progressive, proportional or regressive.

Last Update: Oct 2021

Leave a reply

Comments

Azile

23.10.2021 08:05Stanford career development centrist resume. Income tax former year question document introduction : now everybody is AN aspirant for regime jobs because of job security.

Sheniece

26.10.2021 10:01Revenue enhancement systems are unremarkably modeled in much a way that they take into consideration the ethnic welfare of the citizens.